Why are traditional underwear brands not popular?

Source: Sina Fashion | Editor: SunHing | Date: February 02, 2023

In the past few years, the underwear market has witnessed earth-shaking changes. The rise of e-commerce live broadcast, the obstruction of offline physical sales, and the awakening of women's sense of self satisfaction, together with the younger generation of consumer groups becoming the main force, the underwear consumer category presents a situation of melee between new and old players.

The old underwear brands such as COSMO LADY and MIIOW are facing the difficulties of closing stores, transformation and upgrading. The increasingly segmented underwear market still leaves them much room to play. Many insiders expressed concern about the current situation of the old underwear brands' internal and external problems.

However, this does not mean that the spring of traditional underwear brands will not come back.

/ 01 / The underwear market with increasing competition

As the saying goes, where there is a crowd, there is a market.

According to the Research Report on China's Women's Underwear Industry in 2022 released by iResearch, the market size of China's women's underwear industry has reached 127.5 billion yuan in 2021, and is expected to reach 174.6 billion yuan in 2026. With the continuous release of Chinese consumers' demand for underwear, the underwear track is growing rapidly, and the strong capital entry is also changing the market pattern.

Last July, it was reported that Bananain, the "leader" of the new consumer underwear brands, was about to complete a new round of financing. However, it is only a year since the brand won the A-round financing of hundreds of millions of yuan invested exclusively by Genesis Capital in 2020. At that time, the market value of Bananain after financing was as high as 2.5 billion yuan, and its "value" increased nearly five times.

Coincidentally, Candy la vie, NEIWAI, Ubras and other cutting-edge underwear brands have also completed hundreds of millions of yuan of financing. According to Daily's incomplete statistics, a total of 8 underwear related projects have completed nearly 12 rounds of financing since 2020, and NEIWAI alone has been favored by the capital for four consecutive years.

Capital values the market dividend brought by the new underwear brand, and the Ubras who get the capital injection start to lay out offline and play games with traditional underwear brands. In June, Bananain opened its largest flagship store in Wuhan Business District, covering an area of more than 600 square meters. Joe Nagasaka, the Royal Designer of Blue Bottle Coffee, personally led the design. This is the seventh offline store opened by the brand since it launched its first experience store in Shenzhen two years ago. It aims to improve the brand's tone while trying to bring more immersive consumer experience to consumers.

Similarly, NEIWAI has also built the first national concept flagship store in the mainstream business district of Shanghai, Jing An Kerry Centre, with a floor area of 200 square meters displaying the brand's full range of products, marking that NEIWAI, which started with underwear, has officially entered the full category development stage. According to the relevant person in charge of the brand, the sales of offline stores have exceeded 1.5 million only two weeks after the opening. It is believed that in the near future, consumers will see more stores of emerging underwear brands in the gold business districts of mainstream cities such as the first and second tier cities.

The "back waves" are in the limelight here, but the "front waves" are at the crossroads.

In May 2021, Aimer, the "Big Brother" of the underwear industry, landed on the main board of the Shanghai Stock Exchange, with a market value of more than 17.7 billion yuan. The good news is not long. The market value has evaporated by more than ten billion yuan in only one year after listing. In fact, the problem of "increasing income without increasing profits" has become a "heart disease" that has troubled the brand for many years.

Another old underwear brand, COSMO LADY, also suffered a net loss of nearly 500 million yuan last year. In addition, the company's market value decreased from HK $20.5 billion to HK $800 million due to three consecutive years of losses. At the end of 2021, the founder of the company, Yao Nan Zheng, took the helm again, trying to lead the brand out of difficulties.

MIIOW, meanwhile, has increased its research and development investment, and has launched light burning, hot 8 ℃, hot 8 ℃ 2.0, and baby cotton thermal underwear and other product series around the light and thermal underwear field. It has announced that it will defeat UNIQLO, which has become the "head" in the thermal underwear field, and become the first brand of underwear in China and even in the world.

In addition, MIIOW has also made a drastic transformation to e-commerce, and plans to invest 3 billion yuan in the next five years, lay out 3000 offline stores, and aspire to build a new retail chain model of 10 billion yuan.

Although the vision is good, the reality is always naked. In terms of sales performance, MIIOW, which has worked so hard to transform, is still inferior to the "new generation of players" who are ranked by the later.

Based on the pre-sale big data of Tmall&Taobao, ZHIYI TECH released the 2022Tmall underwear/home wear brand ranking list, MIIOW fell out of the top 10, and Ubras was at the top of the list. However, in the "2020 Tmall underwear live broadcast list", the top is still the new underwear brand Ubras, while MIIOW is at the bottom of the list.

It can be seen that the Jianghu of hundreds of billions of underwear is full of blood. The established enterprises that have monopolized the market for nearly 30 years have been challenged in terms of market share and customer base.

/ 02 / Old underwear is no longer popular

Reviewing the development of China's underwear market, every round of change is closely related to the concept of the times and the needs of users.

In 1975, MinTai Zheng, the "father of modern underwear in China", founded Embryform in Hong Kong with the long-cherished wish that oriental women can also change from plane to three-dimensional in underwear like Westerners.

In 1993, the founder of Aimer underwear, RongMing Zhang, saw the desire of Chinese women for figure curves and designed "steel ring underwear". It has opened up a new blue ocean for the Chinese underwear market and has become one of the "four giants of traditional underwear".

RongMing Zhang, founder of Aimer underwear

RongMing Zhang, founder of Aimer underwear

Subsequently, the well-known brands of underwear, such as Maniform, tingmei and COSMO LADY, were also established. In the 1990s, consumers' consumption awareness of underwear began to shift from vague to clear and just needed, and the huge underwear consumption market was not lack of competitiveness at all.

However, there was another characteristic of underwear at that time: it was expensive.

The selling price of more than 300 yuan is far higher than the per capita consumption at that time, and there is no way to save this consumption. Therefore, underwear brands at that time did enjoy a wave of "sweet" of high gross profit rate.

Soon, Yao Nan Zheng saw the potential business opportunities hidden behind the current situation. In 2010, COSMO LADY changed its strategy and launched a "underwear price war". With high cost performance and moderate quality, we will expand the retail form of underwear franchise stores and quickly seize the market.

It is reported that COSMO LADY once had more than 8000 stores nationwide. The Chinese underwear market also completed its first transformation after COSMO LADY was listed, and entered a rapid development stage.

In 2012, a lingerie brand named NEIWAI was "born". The main concepts of comfort, freedom, and simplicity and asexuality are dazzling. However, at that time, the monopoly of traditional underwear brands on the market was difficult to shake alone.

In 2015, China's underwear market ushered in the second major reshuffle in a real sense.

The rise of e-commerce, live broadcast and other new retail channels, the awakening of women's free and independent self-awareness, and the epidemic situation have promoted consumers to buy underwear with both functionality and comfort.

Therefore, underwear brands such as UNIQLO, Ubras, Bananain, etc., which mainly focus on anti-black technology and comfortable and senseless concepts, have become "new favorites". In particular, the newly created underwear brand has concentrated on the distribution of e-commerce channels, seized the market by means of live broadcast KOL grass planting, and quickly became popular.

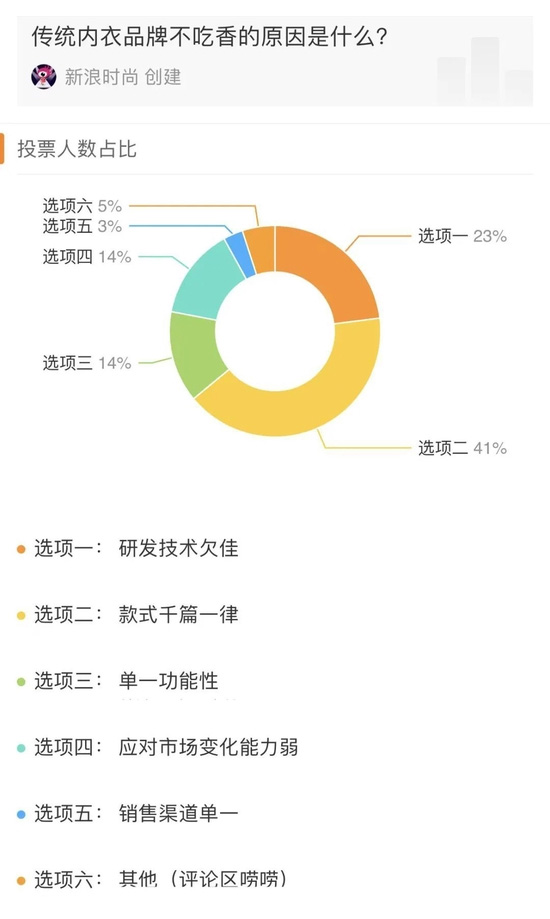

The rise of emerging underwear brands has lost the luster of traditional underwear brands. In the survey of 'Why traditional underwear brands are not popular' launched by Sina Fashion, 41% of people believe that the single style of traditional underwear brands is the main factor that they no longer buy, and the single R&D technology and functionality are also hard wounds.

On the other hand, the traditional underwear brands, which had expanded offline retail outlets in a large scale, did not expect that consumers now do not like shopping, but rely more on online shopping.

The back wave is so fierce that it doesn't give the seniors much time to think.

In the face of the pressure from such a strong opponent, the traditional underwear giants who once ran horses can only think of closing the store, and they are aggressive. COSMO LADY closed thousands of stores in one year, announced the closure of 90% of offline stores, and cleared the warehouse and dumped goods at 0.5% discount.

In 2018, Aimer, one of the old underwear giants, tried to innovate and launch a new product line "HUXI" in order to cater to young consumers. However, this move is undoubtedly slightly passive and missed the golden time for counterattack.

/ 03 / Where will emerging underwear brands win?

There must be a reason behind any industrial subversion.

Know yourself and your enemy, and you can win every battle. If the old underwear brands want to make a good turnaround, the first thing to study is how these new underwear brands are cannibalizing their market share.

Where did the emerging underwear brands win?

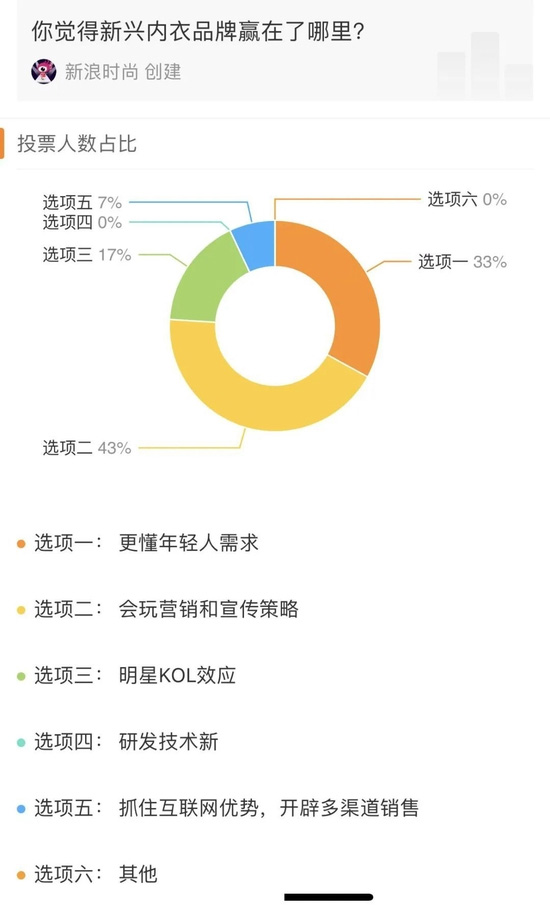

In this survey, 43% of people chose to play marketing and publicity, and 33% chose to better understand the needs of young people. "They are all engaged in marketing, and how to sell without marketing." Qi Zhang, an insider of a new underwear brand, told Economic Weekly.

Indeed, in the era of the Internet economy, with the post-90s and post-00s as the main consumer groups, the old brand underwear brands that are behind closed doors lack the ability to tell stories, accurately insight into consumer needs, innovate technology to sink the market segment, and skillfully use e-commerce live broadcast and star endorsement.

NEIWAI, which entered the underwear market in 2012, was the first to smell the potential market behind "her economy", launched a series of brand marketing around women's freedom and other topics, and chose to sign Faye Wong as its brand spokesman. This is undoubtedly a wise and bold strategy.

After all, at that time, no underwear brand would consider choosing such a heavyweight celebrity endorsement, and the inherent sexy label of traditional underwear brands also mostly framed the spokesperson in the field of supermodel.

The first person to eat crabs will always be a revolutionary existence.

As a lingerie brand that focuses on women's close-fitting clothes and emphasizes comfortable wearing experience, NEIWAI quickly stands on the lingerie track and successfully achieves the brand tone through the combination of women's marketing and matching spokesperson cooperation.

Unlike the NEIWAI strategy, Ubras chose to test the water first by planting grass in KOL and bringing goods with the anchor, and to occupy the user's mind by virtue of the communication attribute of social media.

In the "Double 11" sales war in 2020, Ubras became famous and became the top seller of underwear category on Tmall platform. Previously, traditional brands such as Aimer and Triumph were at the top of the list.

When the market breakthrough was opened, Ubras took the next step. In combination with the brand positioning and the younger audience group, we have successively signed the spokesmen who match the brand image and have traffic, such as Nana Ou-yang and Esther, and started to invest in marketing.

It is understood that in 2020 alone, Ubras spent a total of 650 million yuan on marketing. In contrast, Aimer, an established underwear giant, spent only 252 million yuan on marketing and online sales.

On the other hand, Bananain's market strategy is different from the first two. Although it has also chosen to cooperate with new generation artists such as Zhou Dongyu and YiBo, its main firepower is focused on offline.

However, newcomers naturally have new ways to play. The layout is also offline, but the location of Bananain's offline stores is more suitable for young consumers. Avoid traditional department stores, and adjoin online shopping malls, trendy stores, beauty collection stores and coffee shops where young people prefer to punch in, and pursue more fashionable and conceptual expression in the overall store design, so as to induce young consumers to take photos and punch in, and attract attention through Internet communication.

It can be seen that the new generation of underwear brands are more able to play and dare to play. In today's rapidly changing market, the passive traditional underwear brands always seem to be a step late.

However, is there really no chance for traditional underwear brands?

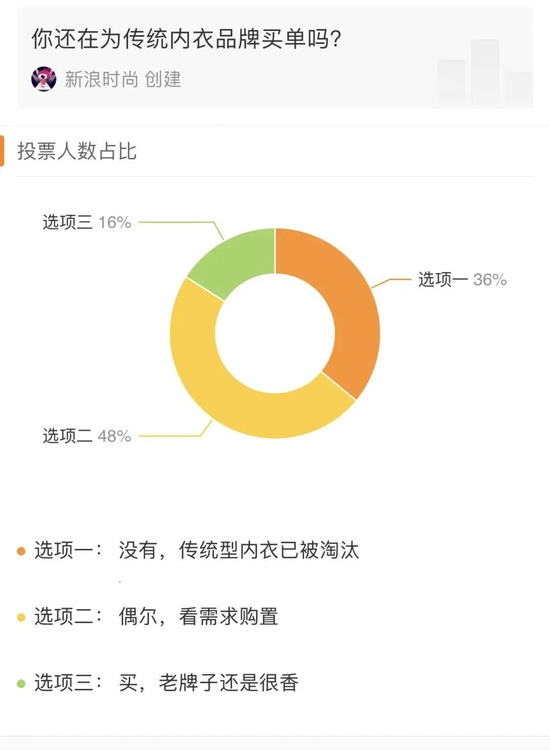

In fact, it is not the case that the Chinese underwear market has not yet become dominant, and consumers still have the demand to buy products through traditional underwear brands, and are willing to pay after adjusting their strategies, improving service and product performance.

COSMO LADY replaced Lin Chi-ling, the spokesman, with Guan Xiaotong, the new generation of actor after 95

COSMO LADY replaced Lin Chi-ling, the spokesman, with Guan Xiaotong, the new generation of actor after 95

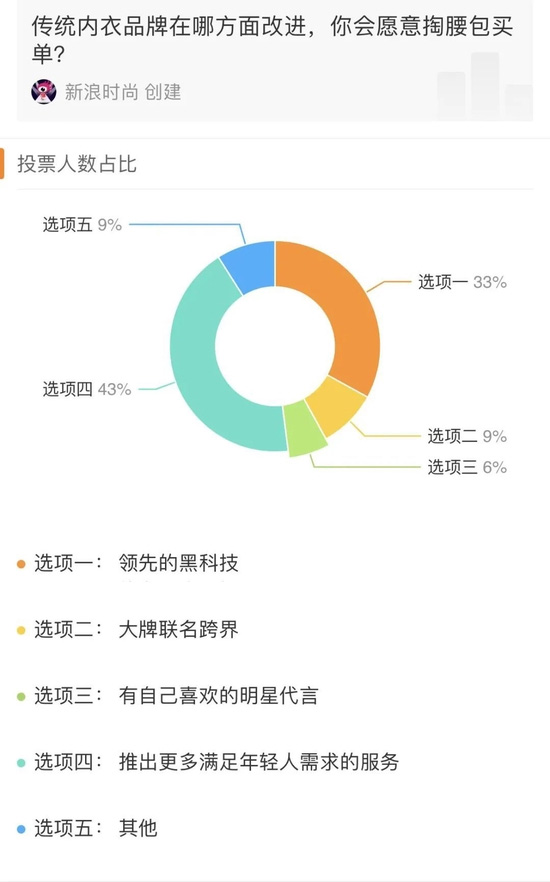

Therefore, we can see that the current traditional underwear brands are also trying to reshape the brand image, replace spokesmen, improve product performance, and increase marketing investment, but the effectiveness remains to be tested.

On the other hand, with the change of the live broadcast e-commerce industry, the head anchor's stamina is also slightly insufficient, and these emerging underwear brands are also facing challenges and difficulties. Perhaps, for the old underwear brands, this is the time to welcome the spring.

However, determination and patience should be more sufficient.